Tips and Tricks eBlast:

Work Types Edition

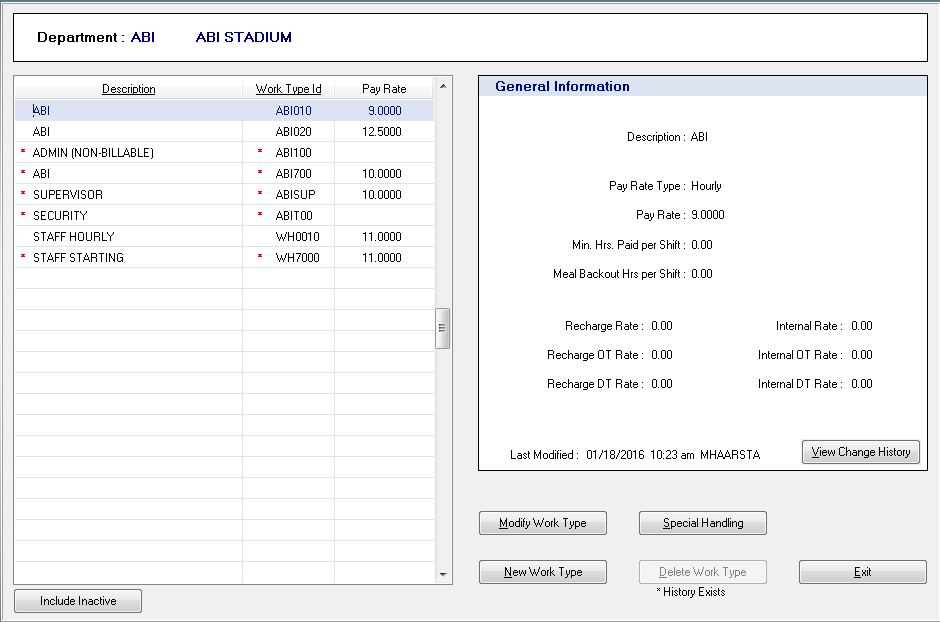

Understanding Template Work Types

There are two Work Types in the ABIMM system, Pay Work Types and Template Work Types. Pay Work Types are the actual pay rates and work rules that are applied to employees’ time records. Template Work Types have three main functions which include grouping positions, labor cost estimation, and labor reporting.Template Work Types are always identified with a red asterisk (Image 1). By attaching a Template Work Type to your positions, the system knows that “SUPERVISOR SECTION 101” and “SUPERVISOR SECTION 207” are both supervisor positions. Grouping these together provides the benefit of knowing how many supervisor positions you have in total, and when building a schedule, knowing how many are available or filled. Tied with that comes the added benefit to utilize a real average hourly wage and your default work rules. By having accurate Template Work Type information you can precisely estimate labor costs for an event before employees are even scheduled. The system takes the Template Work Type for each position you have on your schedule and multiplies the average wage attached with the estimated hours scheduled.

Additional Earnings Amount

Do you have employees that earn additional pay depending on the time of day of their shift? For example, you may have 24 hour security where shifts that cross midnight earn an additional hourly amount. With Work Type based work rules you can have these rules automatically take effect when an employee works through such a time frame. There are options for flat or hourly amounts, how the additional amount is applied, and to apply the amount for more than one time period. For a full guide on applying additional earnings please call our support line.

Skill Pay Rate Overrides

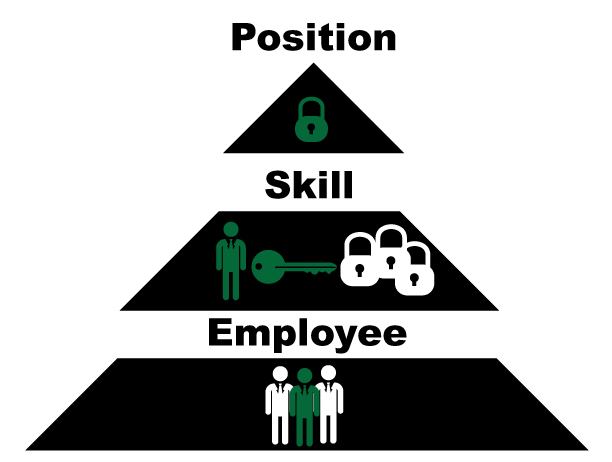

Did you know that you can pay different rates to an employee based on the job/position they work? By applying Pay Work Type overrides to skills you can have an employee automatically earn another specified rate when they work a position utilizing that skill. For example, you have John who can work as an usher or a ticket taker, but he should earn $10 an hour as an usher and $9 an hour when he’s a ticket taker. If you attach the $10 Pay Work Type to his usher skill, the system automatically applies the $10 rate anytime you schedule him for an usher position. You can do the same with a $9 rate on his ticket taker skill. For assistance in implementing these overrides please have HR/Payroll call ABI’s support line.

This represents the order of overrides. Pay Work Types applied on the employee create the base, which can be overridden by a Pay Work Type on an employee’s skills, and ultimately by one on a position.